Of the many decisions, you have to make while running a business, allow me to make one easy for you - saving for retirement. There are two options that are most common - here’s why I recommend the Solo 401(k) over the SEP IRA to my clients.

Note: if you have employees - this post is not for you. If you have contractors, this is still applicable, but if you pay someone a W-2 wage you want to consider other options such as a 401(k) or Simple IRA.

Both plans allow you to save a portion of your business income for retirement and get a tax deduction to boot! You have up until the tax deadline, 4/15 (or 10/15 if you extend) to make a contribution for the previous year based on your taxable income. For example, you have until 4/15/2021 (or 10/15/2021) to contribute for the tax year 2020. Both allow the same maximum contribution - $57,000 for 2020, but there are some BIG differences….

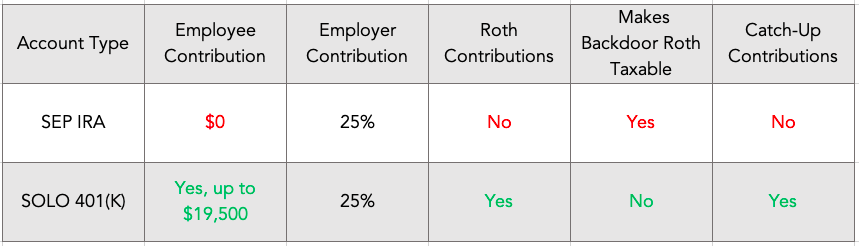

Here’s why I recommend the Solo 401(k) over the SEP-IRA always:

#1: YOU CAN SAVE MORE

You can save a lot more with a Solo 401(k) based on how much you are allowed to contribute:

SEP-IRA: 25% of compensation, up to the max of $57,000

Solo 401(k): Contributions can be made as both the Employee AND the Employer, up to the max of $57,000. Ding ding ding! This is how you can save more:

Employee Contribution: 100% of your earnings up to the max of $19,500 +

Employer Contribution: 25% of your profit

Allow me to break it down…

Let’s say you made $100,000 in profits from your business and want to save for retirement - with a SEP IRA, the max you could contribute is $18,587, but with a Solo 401(k) $38,087! The Solo 401(k) allows you to save more than double i.e. a double tax deduction!

If you're a nerd like me and are wondering why it’s not a perfect 25% of profit, the calculation is complicated. I won’t go into it here, but let’s just say it involves a deduction for ½ of self-employment taxes divided by 1.25. The calculation is also slightly different based on what type of entity you are (S Corp, K-1 Partnership or Sch C).

Save yourself the headache and use this calculator to run the numbers via this handy Fidelity calculator

Note: For those that are S Corps, your contribution is based on your W-2 Wage.

Not convinced yet? Here’s a few more reasons why I prefer the Solo 401(k) over the SEP-IRA:

#2 ROTH CONTRIBUTIONS

If you're in a low tax bracket, you may want to contribute to Roth instead (not take a tax deduction) OR you may be over the limit to contribute to a Roth IRA directly - but with a Solo 401(k), you can contribute to Roth! You can contribute 100% to Roth as an employee contribution. You can also contribute 50% as a tax-deduction with the other 50% towards Roth or the full 100% as a tax deduction. You have flexibility here and can adjust every year based on your tax situation! With a SEP IRA, there is no Roth option.

#3 SOLO 401(k) DOESN’T MESS WITH THE “BACKDOOR ROTH”

SEP IRA’s make “Backdoor Roths” taxable. A lot of my clients make over the income limit to contribute directly to a Roth IRA, so I have them do what is called a “Backdoor Roth” IRA (blog coming soon on this, I swear!). I only advise them to do a Backdoor Roth if it’s not taxable. In order for it not to be taxable, you need to have a $0 balance in any pre-tax IRAs. The SEP-IRA is a pre-tax IRA thus will make the “Backdoor Roth” taxable. A Solo 401(k) doesn’t affect the Backdoor Roth Process. Financial Planner and client are happy - “Backdoor Roth” can be achieved as a non-taxable event AND the client can save for retirement through the business as a tax deduction. #winning

to Summarize

I hope this makes at least one business decision easier. If you want a partner along the way to help make the right decisions for you - taking care of both you and your business, schedule a FREE 30 minute call here.